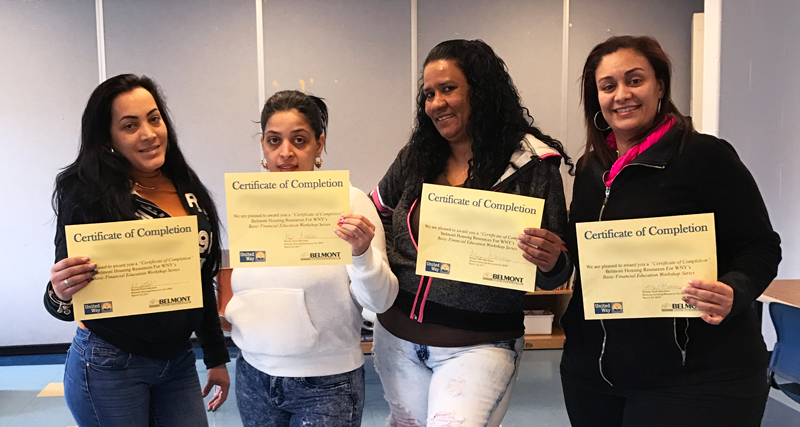

Our FREE financial education workshops are held on a monthly basis. We offer up to 12 hours of classroom instruction intended to help participants develop sound money management habits as a means to achieving their financial goals. The classes cover topics such as budgeting, distinguishing between needs and wants, banking, credit reports and credit scores, credit repair, identity theft, saving and interest, and creating smart goals. The classes are interactive, upbeat and fun.

Click here to register for our next Financial Education Workshop.

Are you buying a home? This free 6-hour workshop covers the full process of purchasing a home, from getting ready, to finding a home, to closing on a home, and more! This class covers the certification requirements for most first time homebuyer programs - including down payment & closing cost assistance programs, First Home Club, Mortgage Closing, and other lender programs.

Pre-registration is required. Click on the blue box above to sign up!

Not ready to commit to the 6-hour class? Are you thinking you want to buy a home but you don't know where to start? This free 1.5 hour class covers what you need to do to prepare for buying a home. Click on the yellow box above to sign-up!

Please note: this workshop is a basic informational workshop. No certificate is given at the end of this workshop.

Can't make it to an in-person class? Belmont has 2 partners that offer the homebuyer education class online. Please note - the fees for the workshop are set by the online provider and are not controlled by Belmont.

However, discount codes may be available for the online class! Contact Tracie at tgroves@belmonthousingwny.org to learn more.

Click on "online homebuyer education" to learn more about our partner workshops.

After the workshop is completed, a free telephone or in-person one-on-one counseling session is required to receive your certificate.

Classes for new homeowners address issues of long-term affordability such as saving for repair and replacement, avoiding home improvement scams, use of credit/predatory loans, refinancing or modifying the mortgage, routine and seasonal maintenance, and creating and sticking to your household budget. Participants also learn about available housing rehabilitation programs, foreclosure prevention techniques and, for seniors, the home equity conversion mortgage.